Our Projects

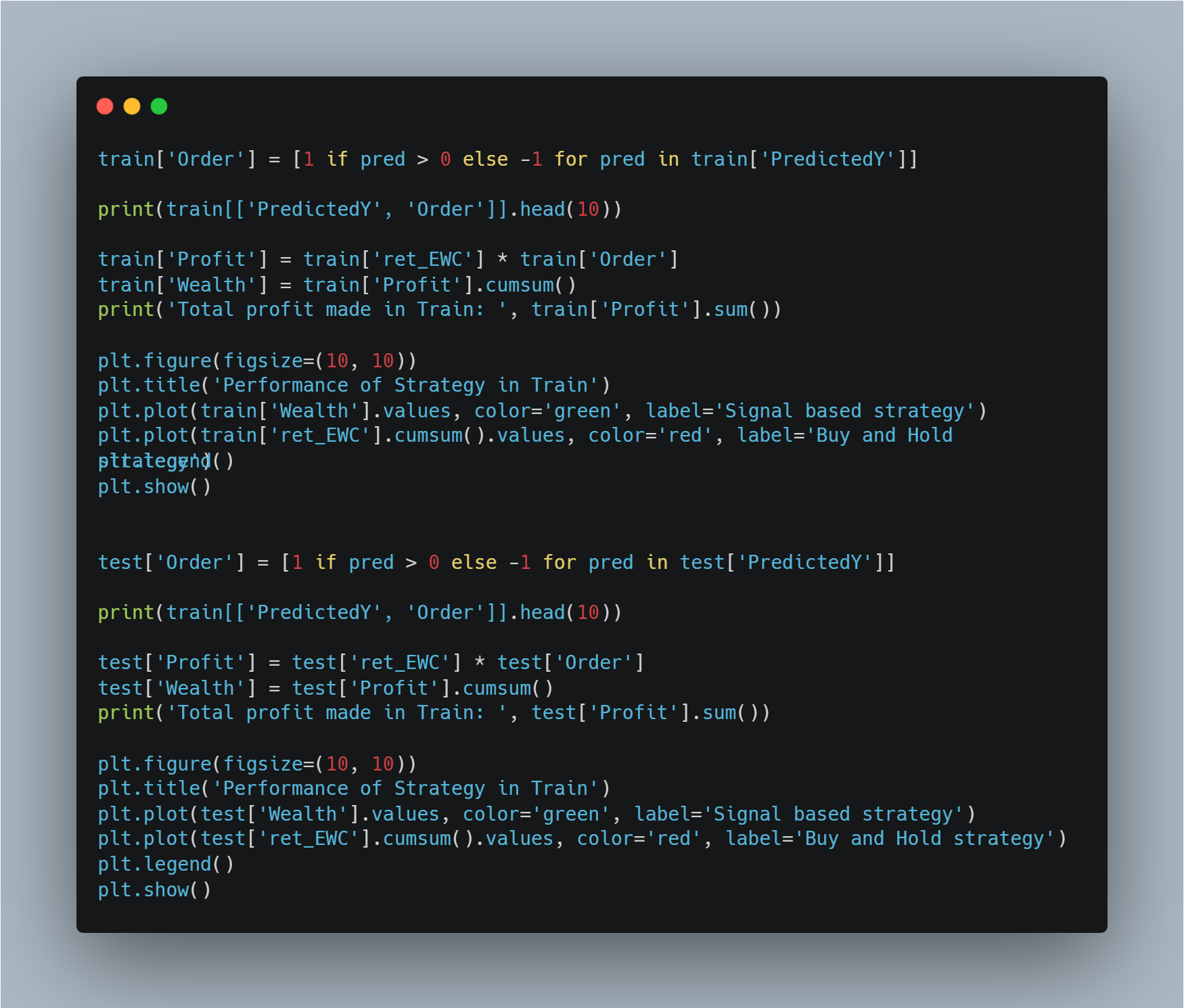

Mean Reverting Strategies

Creation of stationary series from correlated asset portfolios with the goal of statistically arbitraging deviations. This project uses advanced techniques of time series analysis and cointegration to identify trading opportunities.

View Project

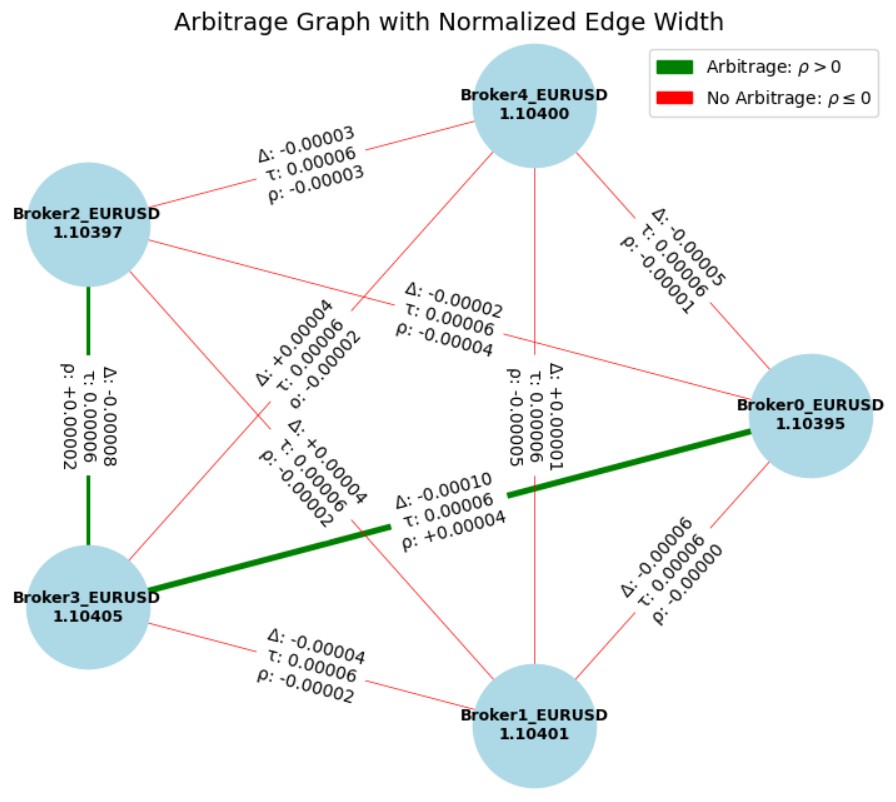

Arbitrage Strategies

Exploration of strategies and conceptual ideas for arbitrage — statistical, token-based, or latency-driven approaches. We develop algorithms that identify and exploit inefficiencies in financial markets.

View Project

Quant Paper Interpreter

An interpretive language model designed to extract, summarize, and explain quantitative finance research papers. Uses artificial intelligence to make the most complex academic research accessible.

View Project

Other Projects

Experimental projects related to data analysis, automation, and alternative financial modeling approaches. We explore new frontiers at the intersection of technology and finance.

Explore More