Spinor TechnologiesManagement

We are a group of students in mathematics, physics, and computer science who combine rigor and innovation to deliver algorithmic, quantitative and programmatic solutions for the financial sector.

Technological solutions that transform financial management.

Tranquility

Knowing that you trust a group of prepared and competent people.

Adaptability

Possibility of having a young, ambitious team up to date with the latest sector developments.

Trust

Security in our decisions and scientifically validated methodologies.

Inspiration

Stimulus to innovate and learn, generating enthusiasm and motivation for financial and personal growth.

Comprehensive Financial Solutions

As students committed to excellence, we offer expertise in quantitative analysis, risk management, and portfolio optimization

Training & Education

Specialized training programs in quantitative finance and algorithmic trading. We share knowledge and advanced methodologies.

Risk Management

Quantitative models to identify and control financial risks with proactive protection strategies.

Optimization

Mathematical optimization techniques to improve processes and strategic decision-making.

Portfolio Management

Tools for investment portfolio construction and analysis using modern optimization techniques.

DeFi Solutions

Guidance in the decentralized environment: new financial instruments, less regulation, and greater control over your assets.

Spinor Technologies.

Students driving financial innovation.

We are a group of students dedicated to delivering real value through innovative quantitative solutions and quality financial education.

After building systems that analyzed hundreds of data points and generated significant returns through quantitative strategies, we help you...

Learn advanced strategies

We share knowledge to leverage data-driven insights.

Build algorithmic systems

Master automation and quantitative development.

Create real value

We deliver practical solutions with a rigorous academic approach.

Case of Study 01: Cross-Stationary EWC-SPY-XAUUSD

Development of a cross-stationary trading strategy combining EWC, SPY, and XAUUSD. By leveraging long-term stationary relationships between equity and commodity assets, the strategy exploits mean-reversion opportunities. Gold mining plays a key role in the global economy, and commodity indices like XAUUSD provide insights into macroeconomic trends, enhancing portfolio optimization

Measured Results:

Total Strategy Return: 0.00%

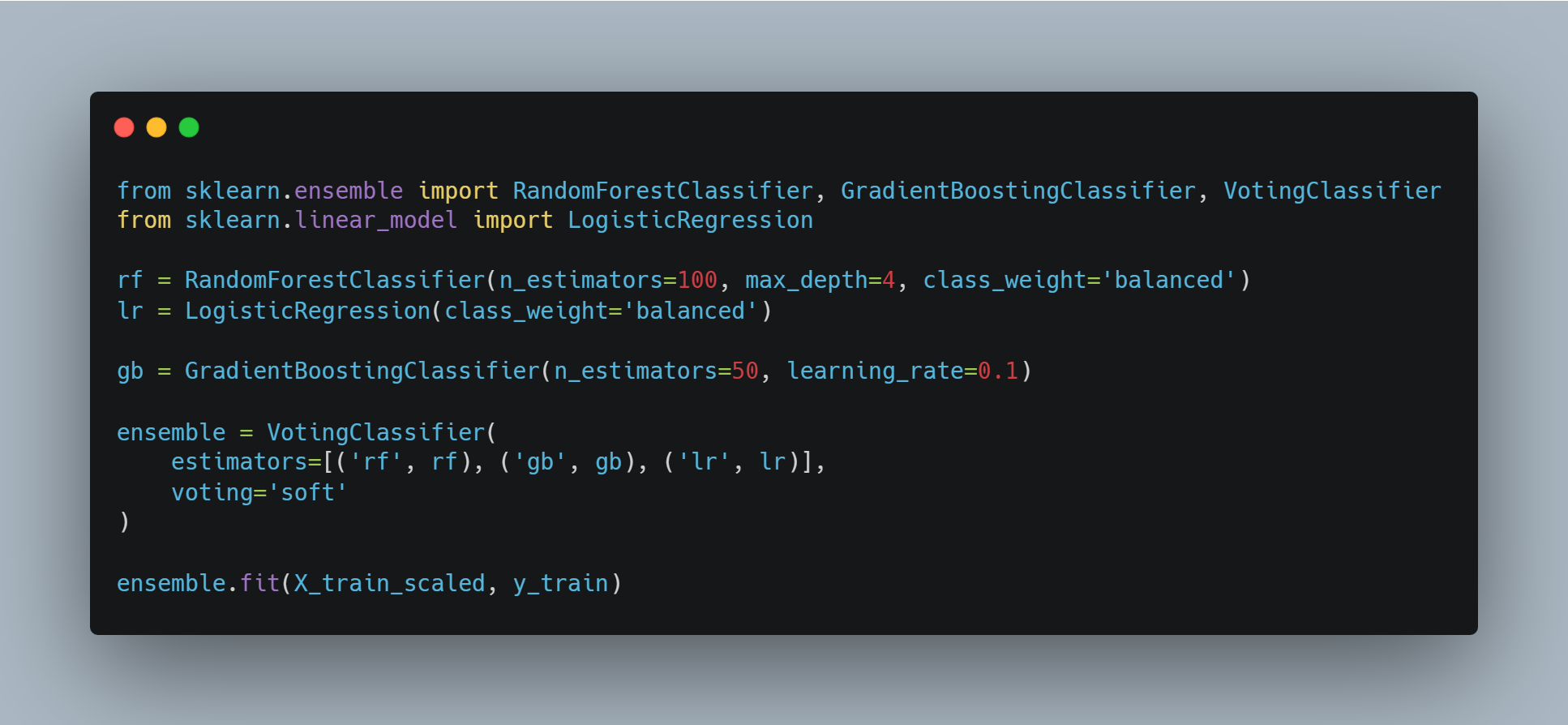

Case of Study 02: Pairs trading system with macro data + ensemble learning

To get High Returns with Low Beta (Market Neutral), we need a pair that hates each other. We need assets that move in opposite directions during stress. We will trade the spread between Consumer Discretionary (XLY) and Consumer Staples (XLP). XLY (Amazon, Tesla, Nike): Rips when the economy is booming. Dies when rates rise. XLP (Coke, P&G, Walmart): Boring. People buy toothpaste even during a crash. Holds value when the market tanks. We use Macro Data (Interest Rates) + Ensemble Learning to predict who wins next week.

Measured Results:

Total Strategy Return: 0.00%

CashFlow Forecasting

Partiendo de un dataset masivo de transacciones, se realiza un affinity market study para analizar la relación entre compras pasadas y futuras, y mediante machine learning se predice el cashflow futuro.

Metrics:

MAE: 0.00

RMSE: 0.00

MAPE: 0.00%

Accuracy: 0.00%

What makes us unique

Passion for learning, innovating, and delivering value with fresh solutions and new perspectives

Have a project in mind?

Let's discuss how our quantitative solutions can add value to your business or investment project.

Tools and Ecosystem